Global Semiconductor Market Sales Exceed $600 Billion in 2024 Electronic Engineering Magazine

February 11, 2025

February 11, 2025

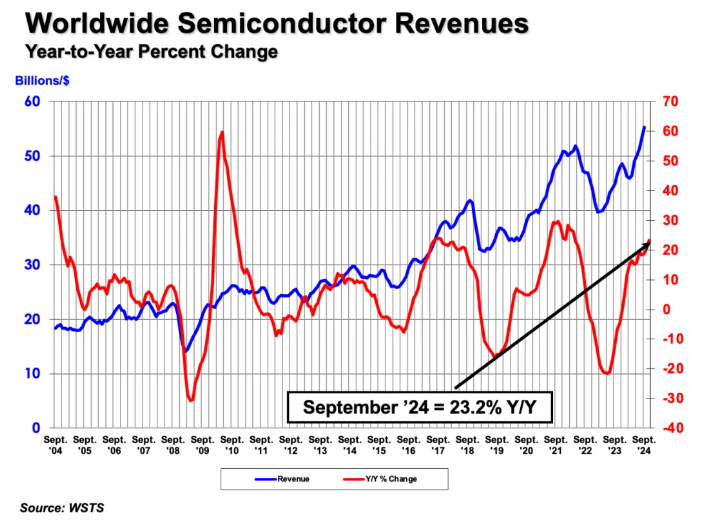

Recently, the Semiconductor Industry Association (SIA) in the United States released new global semiconductor sales data compiled by the World Semiconductor Trade Statistics (WSTS).

In 2024, the global semiconductor market experienced historic growth, with sales surpassing $600 billion for the first time, reaching $627.6 billion (approximately 4.58 trillion RMB). This represents a 19.1% increase compared to 2023, reflecting not only the strong recovery of the semiconductor industry but also its core position in the global economy.

Americas Show Fastest Growth

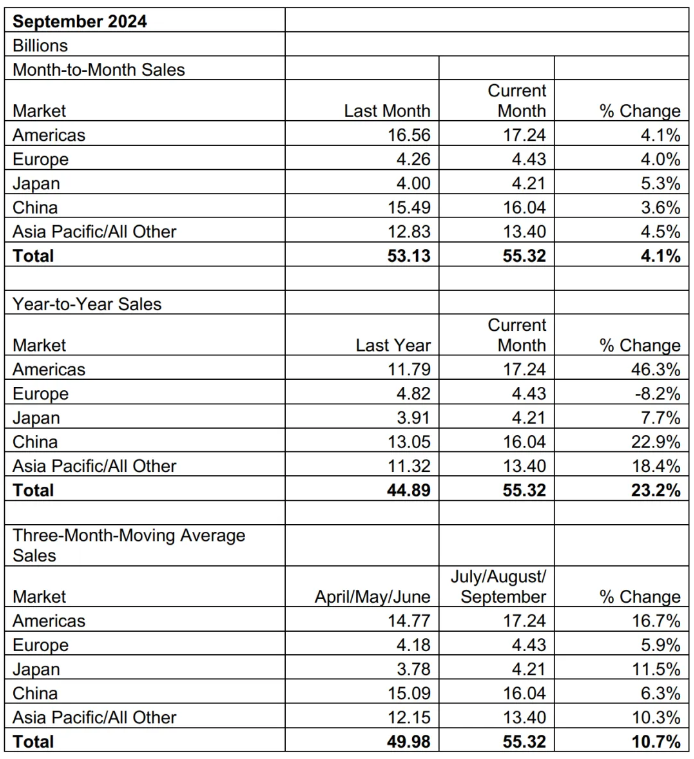

Regionally, there are significant differences in performance. The Americas led with a 44.8% annual growth rate, primarily due to ongoing investments in semiconductor manufacturing and innovation in the United States. China, as the largest semiconductor consumption market, saw an 18.3% increase in annual sales, driven by domestic demand and technological upgrades. The Asia-Pacific region (excluding Japan and mainland China) also achieved a 12.5% growth, underscoring its important role in the global semiconductor supply chain. However, Japan's market saw a 0.4% decline in annual sales, while Europe experienced a significant drop of 8.1%.

Japanese semiconductor companies are gradually falling behind in technological innovation, and the relatively small domestic market faces many challenges in expanding overseas. The decline in the European market is related to rising costs due to the energy crisis, geopolitical uncertainties affecting corporate investment willingness, and R&D progress.

Quarterly and Monthly Sales Trends

In terms of quarterly and monthly sales trends, global semiconductor sales reached $170.9 billion in the fourth quarter of 2024, a 17.1% year-on-year increase and a 3.0% quarter-on-quarter increase. However, December's monthly sales were $57 billion, a 1.2% decline from the previous month, possibly due to seasonal factors and a slowdown in the global economy. From the monthly data, the Americas achieved a 3.2% month-on-month growth in December, demonstrating the resilience of the market in that region. In contrast, monthly sales in the Asia-Pacific region, China, Japan, and Europe all declined, falling by 1.4%, 3.8%, 4.7%, and 6.4%, respectively, which may reflect adjustments in the global supply chain and regional economic imbalances.

Memory Products Show Highest Growth

Certain product categories performed exceptionally well. Logic product sales reached $212.6 billion, making it the largest product category, with growth primarily driven by the continued demand for high-performance logic chips in emerging technologies like AI, 5G communications, and the Internet of Things.

Sales of memory products increased by 78.9%, totaling $165.1 billion, making it the second-largest product category. Within this segment, DRAM product sales grew by 82.6%, the highest percentage increase among all product categories, driven by demand for high-capacity, high-performance memory in data centers, smartphones, and automotive electronics.

The Impact of AI Cannot Be Ignored

Greg LaRocca, SIA's Director of Market Research and Economic Policy, stated that global chip sales are expected to grow by 11.2% by 2025. This growth is significant for the global economy, as continuous advancements in semiconductor technology will further expand applications in fields such as medical devices, communications, defense, artificial intelligence, and advanced transportation, promoting long-term industry growth.

LaRocca also noted that SIA has not yet classified AI chips separately, but most AI technologies are embedded in computer systems that utilize logic chips. The sales of logic chips grew by 81% in 2024, indicating the profound impact of AI technology on the semiconductor market.

John Neuffer, SIA President and CEO, urged Washington leaders to advance policies that promote semiconductor production and innovation, strengthen the high-tech workforce, and restore U.S. trade leadership. It is anticipated that by 2032, domestic chip manufacturing capacity in the U.S. will triple to strengthen supply chains and meet growing global demand.

According to Dragon Ju, Global Vice President of SEMI and President of the China Region, the massive demand for computing power driven by AI and big data will propel the global semiconductor industry to achieve a market size of $1 trillion around 2030, spurred by the development of emerging industries such as AI, related applications, new energy vehicles, and advanced packaging.

China's Outstanding Performance

Against the backdrop of a global semiconductor industry recovery, China's integrated circuit industry has also performed remarkably. According to data from the Ministry of Industry and Information Technology, from January to August 2024, China's integrated circuit production reached 284.5 billion units, a year-on-year increase of 26.6%.

From the supply side, global semiconductor industry investments have shown growth in recent years, with increasing investments in both equipment and facility construction. China's spending on semiconductor manufacturing equipment continues to grow against the trend observed in 2023, maintaining its position as the world's largest semiconductor equipment market. From 2022 to 2026, 109 new wafer fabs will be added globally, with over 70 located in mainland China.